Liability Insurance: Basic but Mandatory

Liability insurance is required in almost every state and is designed to protect others—not you. It helps pay for:

- Injuries to others (Bodily Injury Liability)

- Damage to others’ property (Property Damage Liability)

The Limits of Liability Insurance

It won’t cover repairs to your own vehicle or any of your own medical costs. That’s why it’s often best for low-value cars or drivers with a tight budget.

Full Coverage Insurance: Broader Protection

Full coverage combines:

- Liability

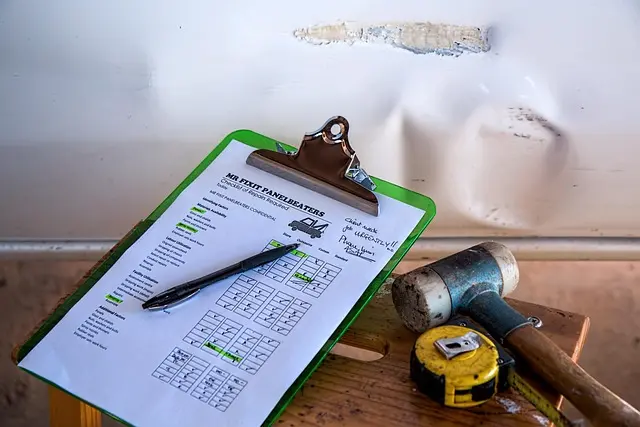

- Collision: Covers your car if you hit another vehicle or object

- Comprehensive: Covers events like theft, hail damage, floods, or animal collisions

Pros and Cons

- Liability Pros: Affordable, meets legal requirements

- Liability Cons: No protection for your car

- Full Coverage Pros: Covers most scenarios, peace of mind

- Full Coverage Cons: Higher monthly premium

What’s Best for You?

If your car is worth less than $4,000 or you can easily replace it, liability may suffice. If your vehicle is new, financed, or essential to your daily life, full coverage is the safer choice.

Conclusion

Don’t let the jargon confuse you. Liability is minimal and cheap, while full coverage offers robust protection at a higher cost. The right choice depends on your vehicle’s value, how much you drive, and how much financial risk you’re comfortable taking. Evaluate your options carefully to stay safe—and save money.